Instead, you could collect an average of $185 every day of the year with this "boring" trade strategy Forbes magazine says is "like finding money in the street." In fact, I've used this strategy consistently to help grow my personal account from $50K (much more than I needed actually) to $5.3M!įor Full Details, Click Here. Like Clockwork.įorget cryptos, pot stocks, and other "shiny object" investments. You can then sync your PC to your iPhone or iPad with a free app so that you don’t have to enter everything more than once. However, once you import your financial data to your Mac, you must take additional steps to enter it into the appropriate categories on Banktivity.

Quicken vs banktivity for mac#

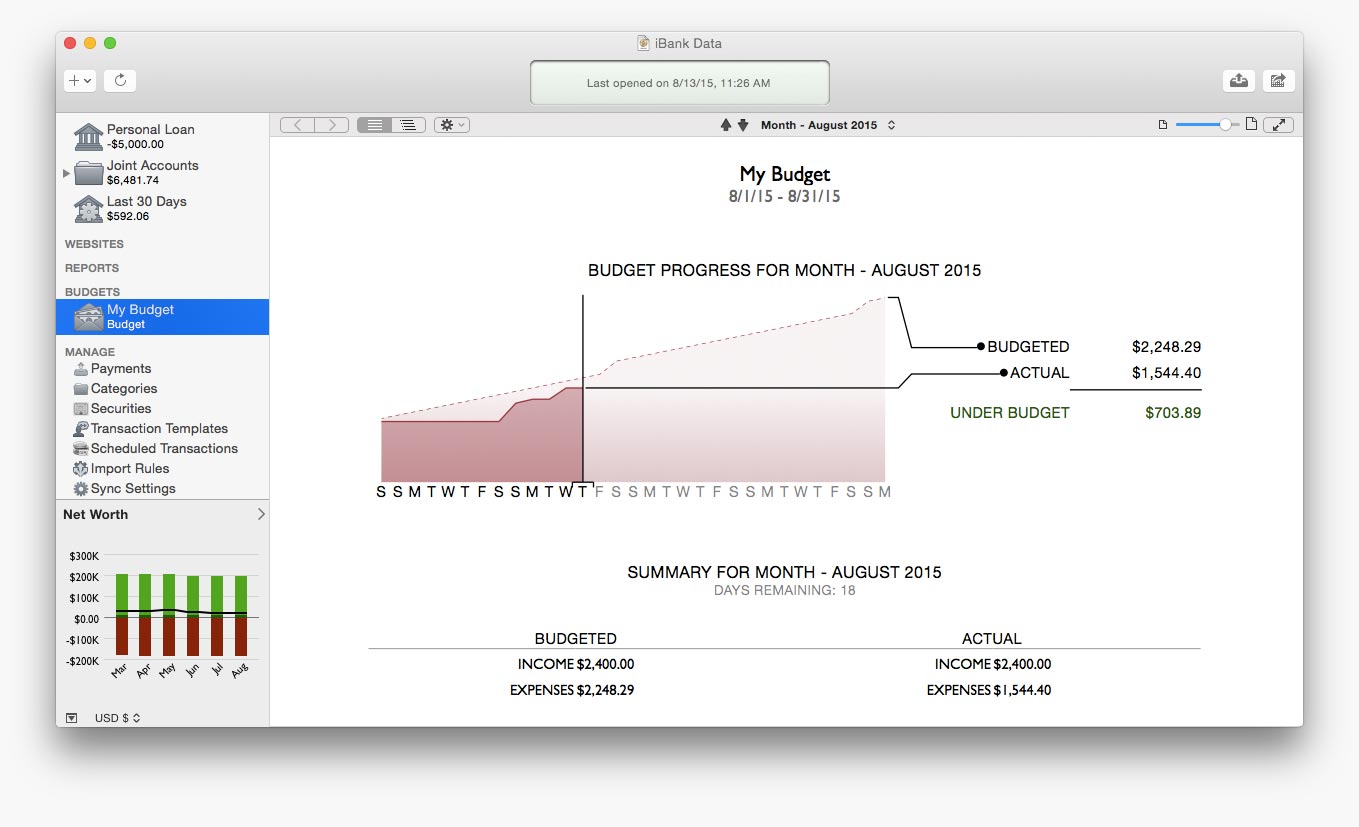

If you ever used Quicken on Windows and switched to a Mac, chances are Banktivity will be more user-friendly because it is exclusively designed for Mac OS.īanktivity simplifies data imports from Quicken so that you can bypass some of those time sinks associated with other budgeting apps. The Banktivity software makes bill paying, expense tracking, and budgeting easy for individuals. What Is Banktivity?īanktivity is a viable alternative to Quicken 2018 for Mac owners who want to get a better grip on their finances. If I don't have your name on my list in the next 2 hours, I'll assume you don't want to make monster dividends. I'll show you exactly where to find the safest companies that pay the highest yields, but only if you click here right now. My portfolio pays out a 26% cash on cash return. Banktivity Review – Budgeting For Mac UsersĢ6% A Year Return. Some of the institutions we work with include Betterment, SoFi, TastyWorks and other brokers and robo-advisors. By letting you know how we receive payment, we strive for the transparency needed to earn your trust. Thank you for taking the time to review products and services on InvestorMint. With an ever increasing list of financial products on the market, we don’t cater to every single one but we do have expansive coverage of financial products. Our goal is to make it easy for you to compare financial products by having access to relevant and accurate information. We strive to maintain the highest levels of editorial integrity by rigorous research and independent analysis. We don’t receive compensation on all products but our research team is paid from our revenues to allow them provide you the up-to-date research content. Revenues we receive finance our own business to allow us better serve you in reviewing and maintaining financial product comparisons and reviews. When you select a product by clicking a link, we may be compensated from the company who services that product. Financial services providers and institutions may pay us a referral fee when customers are approved for products. Investormint endeavors to be transparent in how we monetize our website.

0 kommentar(er)

0 kommentar(er)